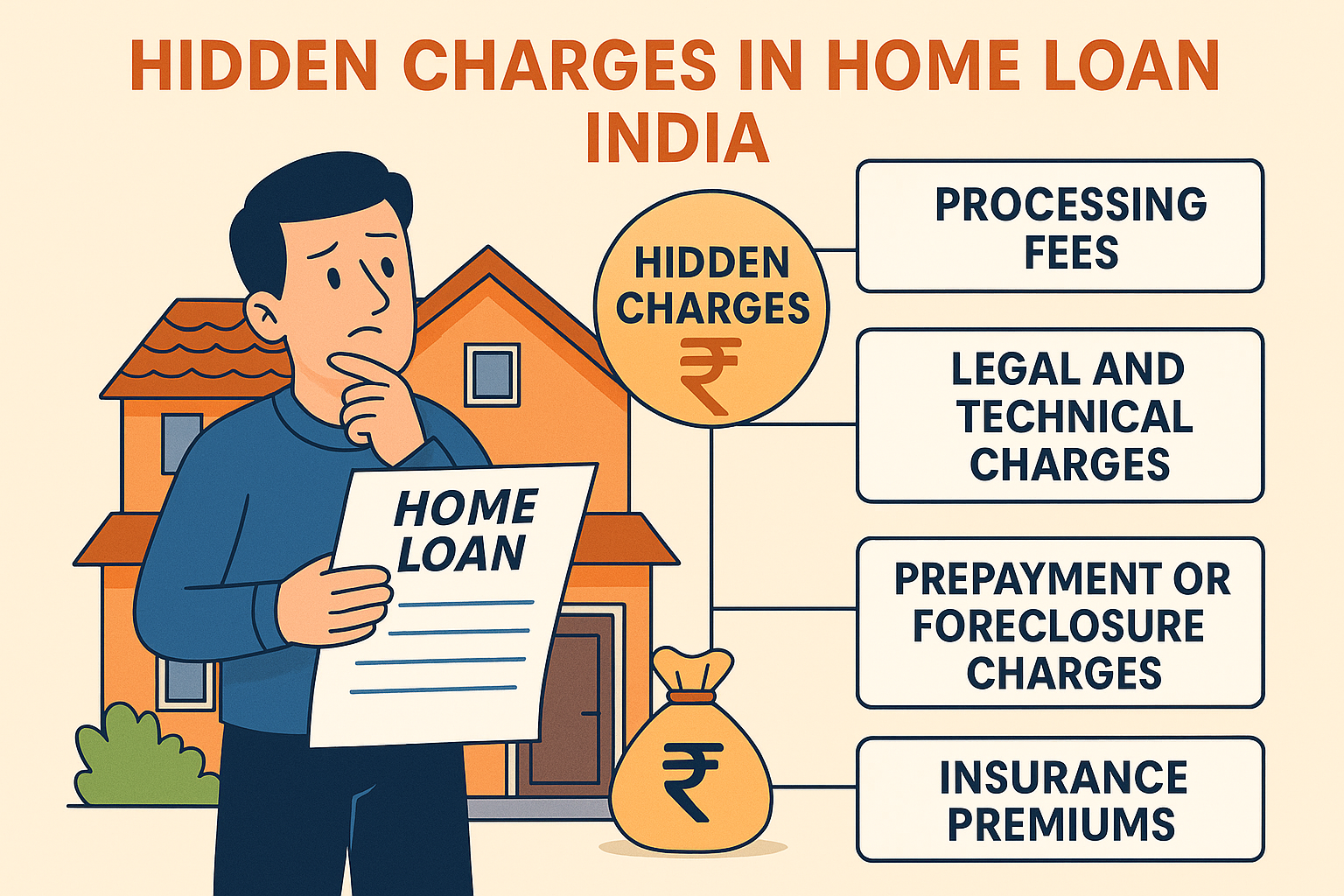

Buying a home is a dream for many, but unexpected costs can ruin your budget. Many first-time buyers are unaware of the Hidden Charges in Home Loan India, which can increase your overall loan expense significantly. In this guide, we’ll uncover these hidden costs and help you make an informed decision in 2025.

Major Hidden Charges in Home Loan India You Should Know

✅ 1. Processing Fees

Almost every lender charges a processing fee, usually between 0.25% to 1% of the loan amount. This is a non-refundable fee, so factor it into your loan calculations.

✅ 2. Legal and Technical Charges

Banks or NBFCs conduct legal verification and property valuation. These Hidden Charges in Home Loan India can cost ₹5,000 to ₹20,000 or more, depending on your property type.

✅ 3. Prepayment or Foreclosure Charges

While home loans on floating rates usually have no foreclosure fees, some lenders may charge for fixed-rate loans or specific conditions. Always clarify these Hidden Charges in Home Loan India before signing the agreement.

✅ 4. Administrative or Documentation Charges

Some lenders add extra administrative charges, file handling fees, or documentation expenses, which often go unnoticed but increase your upfront costs.

✅ 5. Insurance Premiums

Lenders may insist on home insurance or loan protection insurance. Though optional, it’s bundled during the loan process, adding to your overall expenses.

Why It’s Important to Know Hidden Charges in Home Loan India

✔️ Avoid Budget Surprises

✔️ Transparent Loan Planning

✔️ Better Comparison of Loan Offers

✔️ Prevent Financial Stress in Future

How to Minimize Hidden Charges in Home Loan India

✔️ Compare Offers from Multiple Banks and NBFCs on CompareEMI.in

✔️ Ask for a Detailed Cost Breakup

✔️ Negotiate Processing and Administrative Fees

✔️ Read the Loan Agreement Carefully

✔️ Clarify Insurance and Prepayment Terms Upfront

Conclusion: Be Prepared for Hidden Charges in Home Loan India

Understanding the Hidden Charges in Home Loan India is crucial before committing to any home loan in 2025. Use platforms like CompareEMI.in to compare offers, calculate true costs, and choose the most transparent and affordable lender for your home purchase.